Our Impact Funds

Our Focused SDG Funds Invest in Accelerating Sustainability at Scale

Strategy

NEOS Impact is an SDG private equity and debt impact fund manager

As a mission-driven organisation, we invest in growth businesses that are addressing the major drivers of climate change and sustainability in discrete funds aligned to the SDG integrated development goals.

We look for companies and projects that have proven technology, established revenue and strong growth, clear competitive advantage, and experienced teams.

NEOS Impact’s development group has the capability to path-break and path-build for projects and businesses in order to deliver on our mission. Every market has a unique sustainability pathway and investment requirements. So our investment team and development team do not specialize in just one technology, we have expertise and source the right partnerships to deliver them all.

We provide the growth capital needed to scale these initiatives into sustainable businesses and platforms. Our businesses operate on an integrated basis, recognizing that action in one SDG investment fund will affect others positively while providing attractive risk-adjusted returns.

NEOS Impact’s mission is to accelerate the turning point at which we can reach the ambitious targets set by the SDGs. Our creativity, know-how, technology, financial resources, and businesses are expected to have a meaningful impact on this equation.

Impact Funds

Each fund has a distinct development global focus, as well as a unique financial and geographic focus. Our tight focus allows us to pursue deep deployment of proven technologies, business models, expertise, and platforms in multiple geographies.

Our funds are structured to achieve risk-adjusted market-rates-of-return on par with comparable non-impact funds.

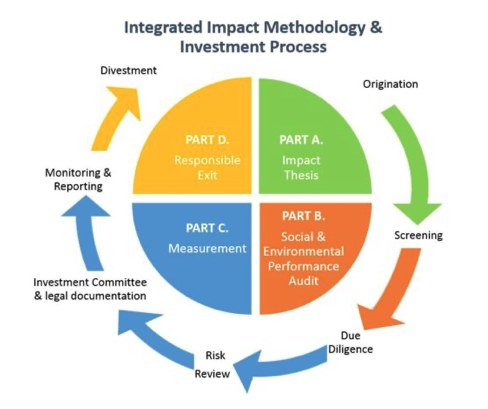

At each stage of our investment process – from origination to exit – we have embedded expert team members, systems, sustainability impact measurement policy, and processes that provide the foundation supporting the financial diligence and stewardship that protects and enhances the performance of our investors’ capital.

Measuring Impact

As a sustainability mission-driven organization, we have integrated measurement and reporting of the positive green impact of our investments and activities with market-leading rigor and transparency.

To deliver on this commitment, in all investment decisions that we make, our four-part impact methodology is embedded in the process.

During origination, we only select investees that aim for a healthy balance between social, environmental, and commercial goals

We assess the operational performance of an investee through a comprehensive Social & Environmental Performance Audit tool.

We want to help our investees develop a realistic impact strategy where they positively and sustainably impact the lives of their end customers.

We want to ensure that each exit meets the financial objectives of our investees and sustained impact post-exit.

Impact Funds overview

Each of our Funds has integrated the SDGs into due diligence, impact target-setting for each investment, and impact monitoring throughout the duration of each loan.

We have developed each of our focused funds to invest in the SDGs at scale. Our flexible capital enables us to be the best possible partner for our portfolio companies and projects. Whilst our single-focused funds allows us to build deep development, investment, and project delivery capability within a theme and technologies – supported by a best-in-class team.

Clean Energy

Investing in energy storage, solar, wind, and thermal power, improving energy productivity, new energy sources, and ensuring energy for all accelerating the transition to green.

Sustainable Industry

Making cities sustainable means investing in businesses that create careers and opportunities, safe & affordable housing, ecological public transport, green spaces, building resilient societies, and economies.

Sustainable Cities

Making cities sustainable means investing in businesses that create career and opportunities, safe & affordable housing, ecological public transport, green spaces, building resilient societies, and economies.

SDG Debt Fund

Risk capital is the core of NEOS Impact's investment business. We provide debt and quasi-equity financing to investees across the SDG investment spectrum.

Tailored Mandates

NEOS has a long history of leveraging our investment and industry expertise to serve governments, financial investors, and corporations who wish to create tailored mandates specific to their needs. These have included venture capital transactions as well as loan guarantee funds.