SDG Debt Fund

SDG Debt Fund: Overview

Some SDG innovative technologies, business models, and projects have a risk profile that may not be suitable for an all-in senior financing solution from traditional financing and investment sources. In many cases, the underlying technology, innovation concept, or life cycle is complex and requires some form of risk capital.

This is where NEOS Impact can help our portfolio companies accelerate their sustainability transition through a wide range of tailor-made financial solutions, including equity and subordinated debt.

Our Debt Financing Lense

We look at transactions through our proprietary SDG investment lens to ensure they have a positive impact. Below is a summary of the key factors we take into account in our deal assessment. We recognize that each sustainable project and business is unique. Please don’t hesitate to contact us even if your business does not tick all the boxes. Our SDG structuring team will develop flexible solutions to suit your company’s needs.

Approach

Global Focus

Our mandate allows us to consider the projects across the globe that accelerate the transition to sustainable financing

Tailored Solutions

We create tailor-made investment solutions to support innovative concepts or technology life cycles that require some form, or risk capital

SDG Impact Focused

We focus on supporting investees that have a measurable SDG impact throughout the investment lifecycle

Partner

We work side by side with projects and companies we fund, acting as a sounding board for management focused on unlocking the value potential of their project and business

Streamlined

Our combination of strong understanding, or your business and our deep experience ensures a streamlined and pragmatic investment process, approval, and documentation of deals

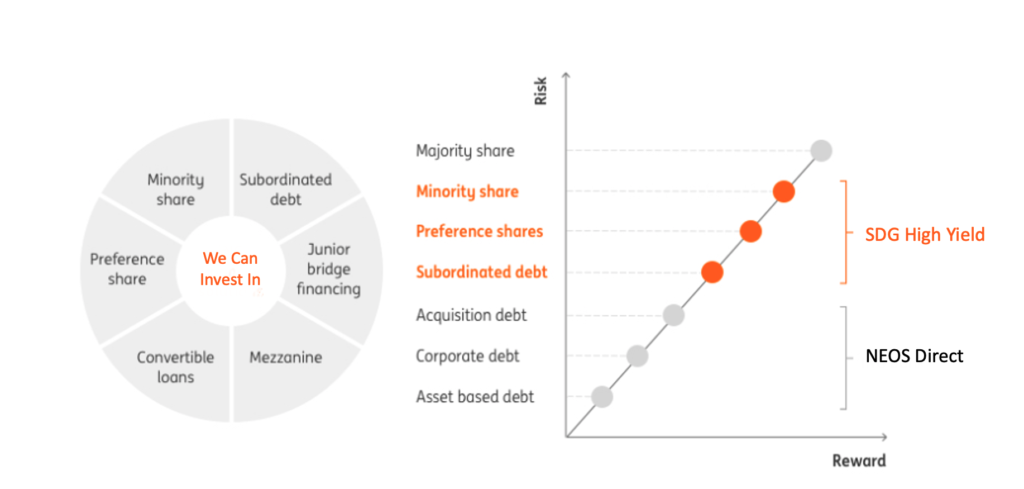

Hybrid debt Focused

We invest in subordinated debt, mezzanine debt, and preference share structures to deliver risk capital to investees to bring their sustainable project to life

Our High yield Debt Fund Team

Our team has extensive experience in direct lending, project and structuring financing and a drive to support the deep deployment of SDG technology and innovative concepts. This enables us to step in when standard financial solutions may not be feasible. Clean energy, real estate, circular economy, innovative industry, and infrastructure businesses are the focus areas in which we can help you grow and bring your sustainable high-impact project or business to life.

Franck Hoppenbrouwers

Koen Tabak

Nick Van Hagen

Franck Hoppenbrouwers

Koen Tabak